2024 National Real Estate predictions, will prices continue falling?

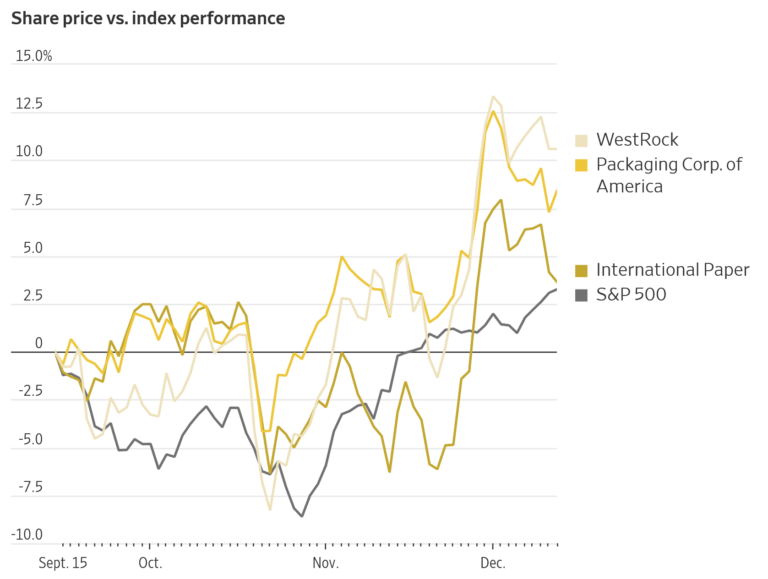

Before getting into my predictions, the chart above is indicative of the mixed signals in the economy. Prices are rising on cardboard due to increased consumer demand. How is demand for cardboard rising if consumer spending is slowing along with inflation? The answer to this question is key to predicting what happens in 2024.

On the real estate front, the beginning of the year started out good but as interest rates rose substantially volumes dropped off a cliff and prices began falling. What do the changes mean for residential and commercial real estate in 2024? Will prices have a larger reset than we are already seeing?

2024 will finally be a big reset in real estate

Regardless of prices, real estate is already in a deep recession, with closing volumes down close to 20 year lows. At the same time interest rates are remaining above 7.5% (as of this writing). Late 2023, we started to see the beginning of what is to come in 2024 with values finally starting to come off their epic run in most cities throughout the country.

Three factors that will shape real estate in 2024

Before getting into my predictions for next year, there are three crucial factors to discuss that will shape the real estate market in 2024 and beyond: Interest rates, inflation, and consumer sentiment. All three are intertwined as they influence each other, but it is important to discuss each one individually to understand how each unique variable will influence real estate in 2022 and beyond.

Inflation:

Inflation continues to run at almost 2 times the Federal reserve target of 2%. There should be some break in the continued price acceleration as supply chains “catch up” with demand. Furthermore, we are seeing in the latest retail numbers that prices are starting to dampen demand a little, which will help. Unfortunately, there are a few categories that will remain elevated for a while: housing and wages that will factor into the price of goods.

Housing: As rates have almost tripled from their lows, housing has gotten considerably more expensive due to financing costs. Furthermore supply continues to be reduced due to the lock in effect. Remember housing makes up over 30% of the CPI calculation.

Wages also look to continue higher as the work force remains constrained either from retirements or others not reentering the work force for several reasons. For example, as inflation and wages increase, so does childcare costs which makes it more difficult for many to justify working if they are spending close to what they are making on childcare. I do not see this issue getting resolved until possibly late 23 which will lead to continued upward pressure on wages, but likely not as much as in 2022 as demand wanes a little.

Interest rates:

The Federal reserve finally came around that inflation is not transitory and as a result they accelerated the wind down of their bond purchases which will put them in a position to pause hiking rates into 2023. The market has picked up the inflation fight for the fed with long term yields finally heading higher even without additional federal reserve hiking.

Some are predicting a quick reversal in the fed next year. I do not see this happening as they are forced to hold rates higher for longer due to the stickiness of inflation and huge deficit spending that further increases pressure on yields. The early indicators of rising cardboard prices is a warning that the road ahead will be bumpy on inflation. These factors will keep mortgage rates in the 6-7% range in 2024.

Consumer Sentiment

Even with huge inflation and predictions of a downturn, the consumer keeps spending. I think late 23 the consumer starts to get “tired out” and will eventually slow spending down as they work through built up pandemic savings. This should help slow inflation, but will not lead to a quick reversal.

The recent bank collapses are a wildcard. So far, the contagion seems to be isolated, but if this spreads consumer confidence will take a large hit.

Multiple macro wildcards to watch in 2024

2024 is a hard year to predict as rates remain high there is increasing probability of something breaking in the economy. Here are some factors I am watching:

- Deficit spending/financing: The federal deficit has basically doubled over the last 3 years and all of this must be financed through the treasury market. As the treasury continues its borrowing rates could continue to spike. I see no end in site to the current deficit spending which will lead to rates higher for longer

- Interest rates/inflation: I’m not convinced that we are totally done with inflation, the labor market is still exceptionally strong which will continue upward pressure on wages and in turn products/services. Rates will have to remain high even in the face of a possible moderate recession

- What breaks? The federal reserve continues touting a soft landing, in order to accomplish this rates will need to remain higher for longer. This drastically raises the risk of something breaking. My first thoughts are commercial real estate and regional banks. But I don’t think the economy will come out of the high rate environment unscathed.

How the three factors above play out could have substantial implications on real estate, for example if something in the economy breaks bad enough like commercial real estate, we could enter a recession with higher unemployment than anticipated. My gut says that rates will stay higher for longer due to the tight labor market and increased deficit spending which ultimately will put pressure on commercial and residential real estate prices.

What are my predictions for real estate in 2024?

2024 still looks to be a transition year, but likely will not happen exactly as economists have planned. Unfortunately, there are more negative than positive risks for real estate heading into the second half of 2024.

In the first half of the year, I do not see the bottom dropping out of prices. There will be some softening with prices dropping in the 5-10% range, some markets will hold steady while others could still increase further. The real test comes in the second half of the year when consumers exhaust their pandemic savings and the bills come due for all the spending.

Furthermore interest rates will remain much higher than the market is currently anticipating, which will ultimately lead to a reset in the economy.

On the commercial side, rising real interest rates will continue to put pressure on cap rates. Remember that the higher the cap rate the lower the value (they work in inverse to each other. Office is going to get destroyed with values dropping around 30% overall due to lower demand, higher financing rates, and much higher cap rates. Retail and Industrial will also come off their highs as cap rates continue to rise to keep up with the rise in treasuries. Rents will not be able to rise fast enough to compensate for the higher cap rates.

The wild card is what happens late 2024 as higher interest rates continue to dampen demand; furthermore, the federal reserve must hold rates higher for longer which will keep rates from falling back to their lows. Worst case scenario 10-15% price drops, likely is somewhere under 15% reset in prices. This will not occur until mid 2024 as the consumer finally comes to terms with increased borrowing costs and slows down their spending.

Commercial is a different ballgame as commercial properties are at much higher risk for larger price drops. For example, large class B office will need a huge reset in prices which could be in the 40%+ range.

Will there be a recession in 2024?

I’m going to put my odds at 75% for a recession in 2024. As rates remain higher commercial real estate values will plunge which will lead to more bank failures and less lending. Eventually the lack of liquidity will flow through to consumer spending leading to a slowdown. Unfortunately, the risks of recession are mounting as there is always a lag in the economy. Furthermore, I think the market is calling the all clear on inflation a bit too soon and will be in for a rude surprise of higher rates.

Summary:

2024 is going to be a bumpy year in real estate. We are already seeing signs of this on the residential side with the median prices off 5% in Denver year over year and volumes down 25%. This is just the beginning of the reset in real estate.

Commercial real estate is a whole different animal with rents dropping, vacancy rising, and ultimately prices facing a huge reset especially in the office sector along with multifamily. If rates remain higher for longer, there will be increasing stress on every commercial property type as cap rates remain elevated.

Anyone in residential or commercial real estate is going to have a tough ride as volumes will stay extremely low throughout the nation until there is a major reset in the economy that forces individuals and businesses to sell and rates to fall substantially. Long and short 2024 looks like a tough year in real estate that will likely worsen for most compared to 2023. Fortunately every single cycle creates new opportunities and we can always look forward to 2025

Related Posts