Bloomberg) — It’s the surprise of a spring selling season that’s been anything but normal: Buyers returning to the housing market have been battling over the few available properties.

While sales are way down, the lack of inventory has propped up prices and led to bidding wars, even as economic fallout from the pandemic mounts and real estate agents adjust to new public health guidelines that have made it more difficult to market homes.

“Since the pandemic began, demand fell off a cliff,” said Taylor Marr, an economist at Redfin Corp. “What most people overlook is that sellers also pulled back.”

The supply-demand imbalance meant that roughly 40% of homebuyers that Redfin agents worked with recently faced competition when they tried to purchase a home. The rate was even higher in cities like San Francisco, Boston and even Fort Worth, Texas, where more than 60% of properties the company’s clients bid on received multiple offers.

The U.S. housing market went into the Covid crisis with a supply shortage that was driving up prices beyond the reach of many buyers, even with years of low interest rates. That problem hasn’t gone away, despite the economic uncertainty. The number of active listings shrank by almost a quarter in April, compared with a year earlier, according to Redfin.

Still, the market has cooled. Sales of existing homes are projected to fall 20% in April from a month earlier, according to estimates compiled by Bloomberg. That would follow an 8.5% drop in March. Construction of new houses plunged by the most on record in April, with builders waiting out the virus. That means new supply will be slower to materialize.

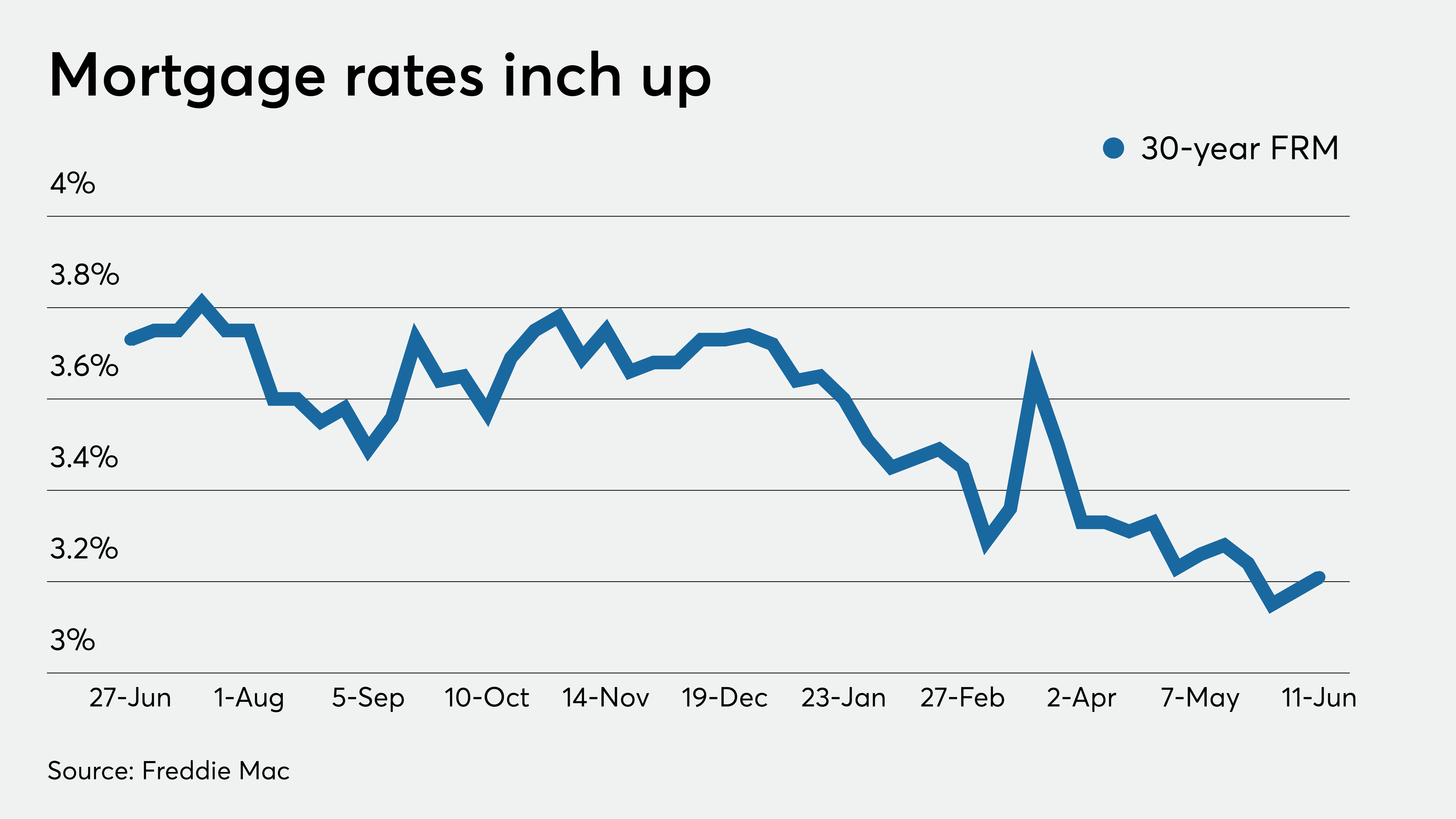

The market dynamics are a shock to some buyers. Kenzo Teves, a 24-year-old business analyst for a pharmaceutical company, decided to start shopping for his first house this spring, because interest rates were so low. He had money saved for a down payment and was secure in his job — factors he thought would help him find a home near Boston.

In late April, he made his first bid on a three-bedroom house in Chelsea, Massachusetts, that was listed for $420,000. The property got six other offers and even bidding $30,000 over the asking price wasn’t enough to cinch the deal.

“It’s pretty strange,” he said. “I would have thought that it would have tipped more to my favor as a buyer.”

The inventory shortage is being felt in smaller cities, too. Kim Park, an agent with Keller Williams Realty in Boise, Idaho, said her business is down about 20% because sales have slowed. But bargains are still hard to find.

She’s working with a young family with two kids and a rental lease coming up for renewal next month. To buy a house for almost $300,000, they had to fight off three other bidders and pay $10,000 above asking price, Park said. They got it only because the winning bidder’s financing fell through.

Homeowners in Boise are staying put, worried about about letting potential buyers in during the pandemic or upgrading to a more expensive property when employment is so tenuous.

“It’s made our tight market that much tighter,” Park said.

In Los Angeles, Sally Forster Jones said two of her clients bid unsuccessfully this month on two different houses. One was listed for about $800,000 and the other for less than $1.5 million. Each received more than 30 offers and are now in escrow at above the listed price. Jones declined to share specifics on the homes because her clients made backup offers and she doesn’t want to invite more competition.

“I’m encouraging my sellers to put their property back on the market,” she said. “The fact that there’s limited inventory is to their advantage right now.”

Not all real estate agents see cutthroat competition. Nina Hatvany, a luxury agent with Compass in San Francisco, said buyers are coming back to the market but the complications of showing houses during a pandemic has weeded out all but the most motivated people. And, even then, there’s sometimes a mismatch between what people think a property is worth.

“I’ve got plenty of buyers saying, ‘I’m ready to buy if it’s a good price,’” she said. Meanwhile, “the sellers are worried about taking a big hit.”

Home prices will hold up, at least through the summer, but declines are coming, said Mark Zandi, chief economist at Moody’s Analytics. Once foreclosure moratoriums and forbearance programs end, lenders will start repossessions as unemployment persists. Ultimately, as many as 2 million homeowners will lose properties because of the the pandemic, he said.

In the near term, buyers are going to have to slug it out, especially for the types of property that are most in demand. Redfin’s data show that houses listed below $1 million were the most competitive, partly because banks have tightened standards for jumbo loans, said Marr. With everyone sheltering in place, buyers are also more eager to buy single-family houses than condos.

https://www.yahoo.com/finance/news/bidding-wars-back-even-housing-150005227.html