Homes continue to sell at fastest pace in 2 years

It means that potential buyers should be prepared to strike quickly, and sellers who have been on the fence through the onset of the coronavirus pandemic might now want to list.

Though many sellers have taken a wait-and-see approach through the pandemic, homes that have made it onto the market have been snatched up relatively quickly by eager buyers. In mid-June, the typical home sold in the U.S. had an offer accepted 22 days after it was listed for sale. That’s as fast as homes have sold since early June 2018, when they typically sold in 21 days. Even at the slowest point of the spring – in late May – that number only climbed to 31 days, just six days slower than late May last year.

The same limited-inventory dynamic – with sellers pulling back from the market more than buyers – has kept home prices relatively steady during the pandemic, though signs point to a modest decline in the coming months.

More homes are coming onto the market – new listings are up 14% month over month – showing sellers appear to be gaining confidence in that buyer demand. Many who listed their homes during the past few weeks were rewarded with a quick sale. Inventory remains incredibly tight and sales are happening quickly, so buyers should be prepared to move fast when they find a home they’re interested in.

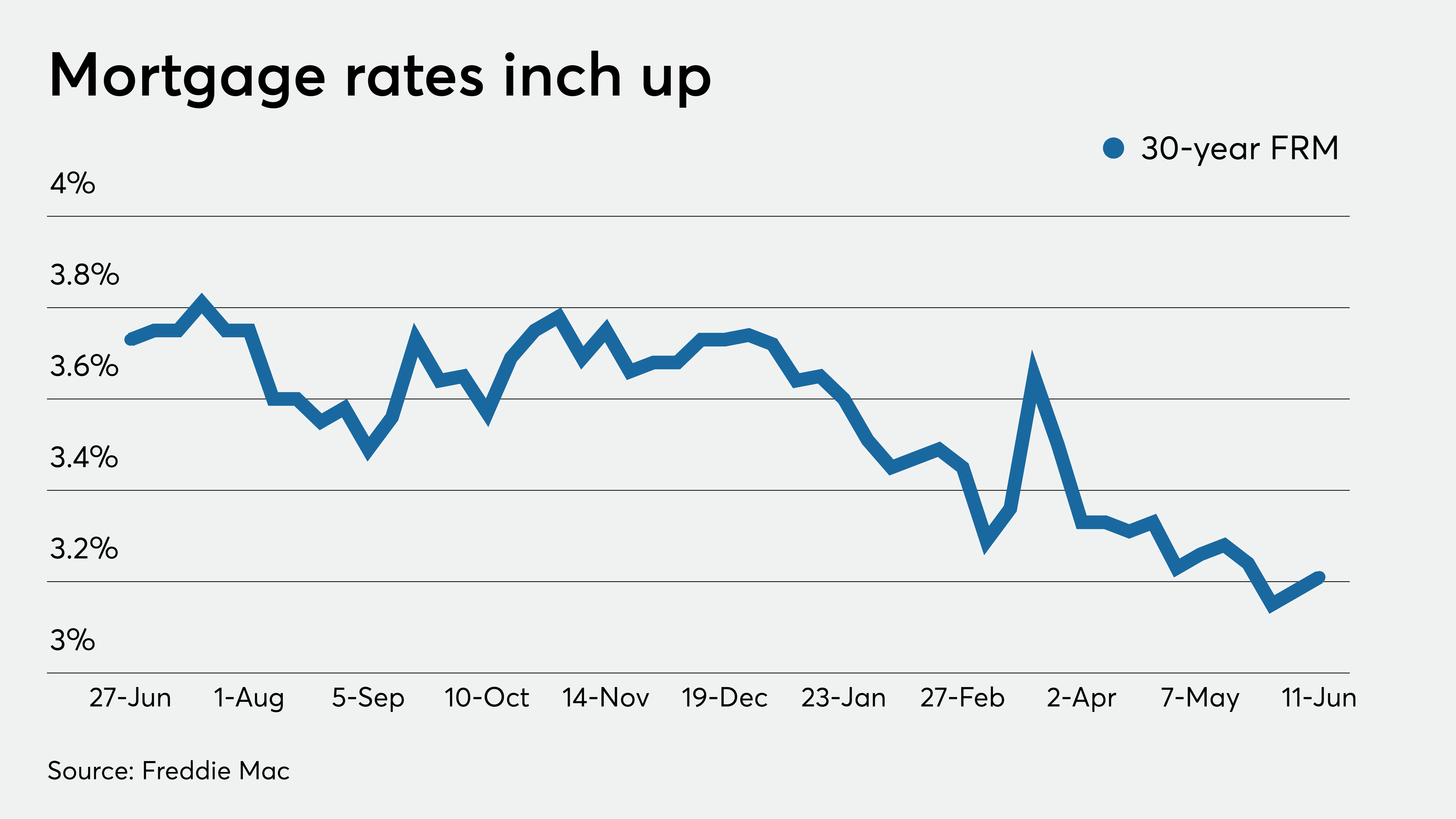

“Buyers shopping today might expect to be welcomed by desperate sellers, but they’ll instead discover houses selling like hotcakes in the speediest market in recent memory,” said Zillow economist Jeff Tucker. “The market did slow down in April, but anyone shopping this summer needs to be prepared to keep up with the lightning-quick pace of sales today. The question is whether the tempo will slow after buyers finish playing catch-up from planned spring moves, or if this fast-paced market will stay hot thanks to continued low interest rates and buyers scrambling over record-low summer inventory.”

In 29 of the 35 largest U.S. metros, homes are typically seeing offers accepted faster than a year ago. Homes are selling the fastest – in only five days – in Columbus. Cincinnati (six days), Kansas City (six days), Seattle (seven days) and Indianapolis (seven days) are just behind. Pittsburgh has seen the most dramatic acceleration of late, with sellers typically accepting an offer 17 days sooner than at this time last year and 40 days sooner than a month ago.

The slowest market by some margin is New York, where homes are typically spending 70 days on the market before an offer is accepted, more than three weeks longer than at this time last year. Miami (55 days) and Atlanta (38 days) are the next slowest.

New York and Miami have typically been among the slowest-moving for-sale markets, so the recent slowdown may not be fully attributable to the pandemic. Still, the year-over-year slowdown of 23 days in New York is the biggest in the country, and the six-day slowdown in Miami is the third-biggest behind New York and Atlanta.