House Flipping? How to Flip a House the Right Way

Successful house flipping requires careful planning, hard work, and a thorough understanding of the real estate market. In this blog post, we’ll guide you through the essential steps to flip a house the right way, ensuring you maximize your chances of a profitable outcome.

Step 1: Research Your Market

Before you dive into the world of house flipping, it’s crucial to research your local real estate market. Understanding current trends, property values, and neighborhoods with potential for growth is essential. Look for areas where homes are in demand and likely to appreciate in value. Conduct thorough market research to identify your target audience and what they’re looking for in a home.

Step 2: Set a Realistic Budget

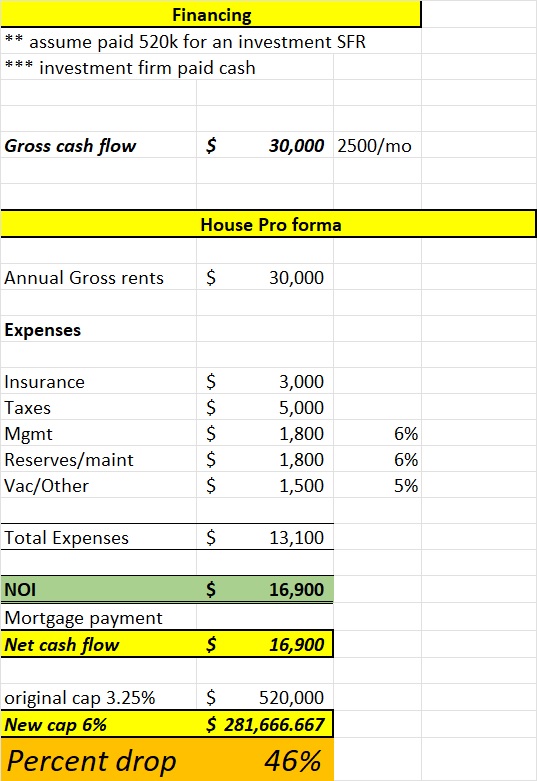

One of the most common mistakes in house flipping is underestimating costs. Create a detailed budget that includes the purchase price, renovation expenses, holding costs (property taxes, utilities, insurance), and selling costs (agent commissions, closing costs). Be sure to leave room for unexpected expenses, as they often arise in the renovation process. A realistic budget is key to avoiding financial setbacks.

Step 3: Secure Financing

Unless you have significant personal funds, you’ll need to secure financing for your house flipping project. Options include traditional mortgages, hard money loans, private investors, or partnerships. Choose the financing option that aligns with your budget and timeline. Be prepared to present a solid business plan to potential lenders or investors.

Step 4: Find the Right Property

Locating the right property is a critical step in the house flipping process. Look for homes with good bones, in desirable neighborhoods, and with the potential for value appreciation. Pay attention to the property’s condition and the extent of renovations needed. It’s often better to start with a cosmetic fixer-upper for your first flip, as major structural issues can be costly and complex.

Step 5: Renovate Wisely

Effective renovation is the heart of successful house flipping. Create a renovation plan that balances cost-effectiveness with aesthetics and functionality. Focus on kitchen and bathroom updates, fresh paint, flooring, and curb appeal. Be sure to obtain the necessary permits and hire reputable contractors. Keep a close eye on the renovation process to ensure it stays on schedule and within budget.

Step 6: Market Strategically

Once the renovations are complete, it’s time to market the property effectively. Work with a real estate agent who has experience in selling flipped properties. Invest in professional photography and staging to make the home look its best. Price the property competitively to attract potential buyers while still ensuring a profit.

Step 7: Sell at the Right Time

Timing is crucial in house flipping. Pay attention to the market cycle in your area and aim to sell when demand is high. A well-timed sale can maximize your profit potential.

Step 8: Learn and Adapt

Even if your first flip isn’t as profitable as you hoped, it’s essential to learn from the experience. Evaluate what went well and what could be improved. House flipping is a learning process, and each project provides valuable insights for future success.

Flipping a house can be a rewarding and profitable venture when done correctly. It’s essential to approach it with careful planning, realistic expectations, and a willingness to adapt and learn. By conducting thorough research, setting a budget, securing financing, choosing the right property, renovating wisely, marketing effectively, and timing your sale strategically, you can flip a house the right way and set yourself up for success in the world of real estate investment. Muevo is your partner in achieving success in the world of house flipping. Contact us today to learn how our expertise and resources can help you navigate the challenges and opportunities of house flipping, ensuring that you flip houses the right way and achieve your financial goals. Your success is our priority, and together, we can turn your house flipping dreams into a profitable reality.